What You Must Know

- Vanguard pioneered a dual-share construction over twenty years in the past, which helped its funds generate larger after-tax returns.

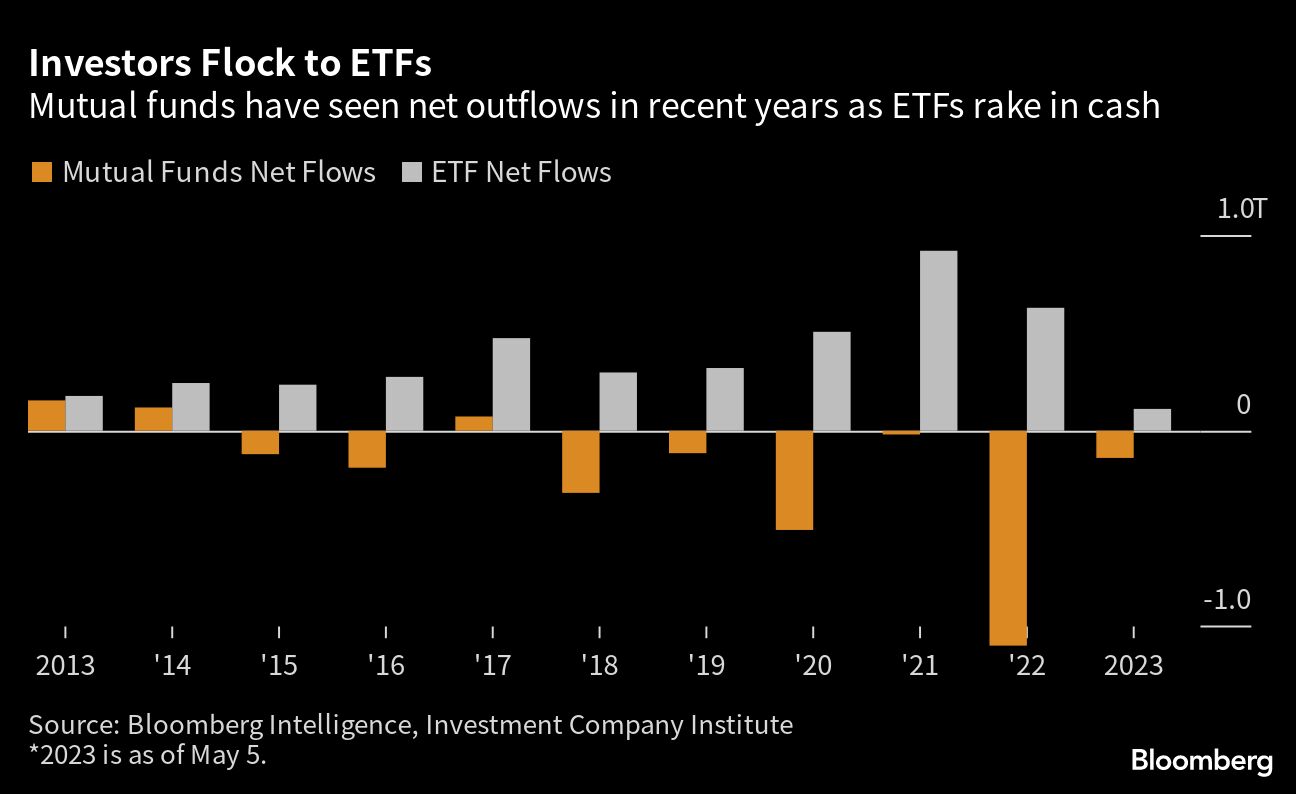

- Whereas Constancy has $36 million as we speak in ETF belongings, Vanguard has over $2 trillion

- Constancy mentioned portfolio managers answerable for funds with the dual-share construction might have interaction in some tax administration.

Constancy Investments is searching for clearance that will permit a few of its best-known mutual funds to additionally function as exchange-traded funds, changing into the most important agency to problem Vanguard Group’s former monopoly on the idea.

The Boston-based agency utilized Tuesday for a authorities waiver that will permit its actively managed mutual funds to additionally situation a separate class of ETF shares, in line with a regulatory submitting.

Vanguard pioneered and started patenting this dual-share construction greater than twenty years in the past, which helped its funds generate larger after-tax returns and seize virtually a 3rd of the U.S. marketplace for ETFs.

The final of its patents expired in Could, offering corporations comparable to Constancy with a neater method to package deal their stock- and bond-picking methods into ETFs.

“Constancy’s mainstay has been lively administration, and till this time limit, it has been very tough to get ETFs round lively funds,” mentioned Gus Sauter, who co-invented Vanguard’s patent whereas serving as its chief funding officer. “I believe Constancy is taking a look at this as a chance to get into the house in a giant manner.”

A Constancy spokesperson declined to remark.

The twin-share class construction provides mutual funds entry to the tax benefits of ETFs, boosting after-tax returns.

Distinct tax remedies have traditionally separated the ETF and mutual fund classes, with the previous in a position to keep away from capital-gains levies by way of its distinctive in-kind redemption course of.

Vanguard, by creating ETF lessons for a few of its conventional merchandise, has used the design — solely legally — to slash the taxes reported by its funds for greater than 20 years.

Constancy mentioned in its software that portfolio managers who oversee dual-class funds might have interaction in “cautious tax administration.”

‘Massive Strikes’

When U.S. regulators launched sweeping rule modifications in 2019 to make launching ETFs simpler, the U.S. Securities and Change Fee intentionally retained the necessity for issuers to use for an exemption in the event that they wished to pursue ETFs in a multiple-share class construction.