In 2024, I’m transitioning from a spender to a saver mindset. I’m returning to frugal habits paying homage to my life-style within the first 13 years after school. This modification is prompted by the necessity to rebuild liquidity.

One space I am concentrating on to chop bills is meals. After a three-month experiment involving elevated spending on meals, I grew bored with the surplus. Now, I am swinging the opposite manner—planning to eat much less for weight reduction, choosing leftovers, and cooking extra to economize.

The primary day of the brand new yr marked a optimistic begin towards attaining my 2024 objectives. I rose early to edit and publish a put up, adopted by a 1.5-hour pickleball session—a dedication tied to my New Yr’s resolutions.

Nevertheless, upon returning dwelling at 11:35 am, my optimism took successful after I found an Uber Eats supply driver blocking my driveway. Perplexed, I inquired concerning the deal with he was trying to find, solely to appreciate it was mine.

To my chagrin, my spouse had ordered $48 price of udon noodles for the youngsters, whereas I had mentally ready to make cost-free grilled cheese sandwiches. Yum! Unbeknownst to me, they’d already eaten grilled cheese for breakfast.

Can Be Onerous To Get On The Identical Monetary Web page As a Couple

Sometimes, I am okay with spending cash on meals supply to save lots of time. My spouse was being productive, modifying the ultimate chapters of my new e book. Nevertheless, with my decision to economize within the new yr, I felt disillusioned on the very first day.

Here is the factor: at 12:35 pm, we have been heading to a buddy’s New Yr’s occasion, which I attended with our son final yr. They host an ideal occasion with a ton of meals and drinks! So, stuffing ourselves beforehand and spending $48 on lunch felt like a double kick within the nuts.

We solely argued for a minute after which moved on. But it surely acquired me enthusiastic about how troublesome it may be for {couples} to get on the identical monetary web page, particularly when there’s a desired shift in spending habits.

On the finish of the day, I didn’t do the next:

- Clearly talk that I wish to spend much less cash on meals this yr.

- Inform my spouse there’s loads of meals for each adults and youngsters to eat on the New Yr’s lunch occasion.

- Put together meals for my youngsters earlier than leaving to play pickleball for an hour.

How To Undertake The Identical Monetary Targets With Your Associate

The reason for many arguments between {couples} typically stems from unstated expectations. I had revealed my 2024 objectives put up and anticipated we’d get monetary savings on lunch by attending a buddy’s lunch occasion. The issue is, I did not share my expectations with my spouse.

To me, I simply assumed this was a logical conclusion. To her, she didn’t know what to anticipate from the occasion and was busy working. She was additionally ordering further to care for dinner for all of us and persevering with a Japanese custom of consuming noodles on New Yr’s Day for lengthy life.

In her thoughts, logically, it was higher to feed our youngsters earlier than the lunch occasion to keep away from hangry meltdowns and hold them completely satisfied. For reference, our children normally eat lunch at 11:30 am, so having them wait to eat till 1 pm could be a recipe for potential meltdowns.

Getting on the identical monetary web page along with your companion is essential for a harmonious relationship and might considerably reduce arguments. Listed below are 10 methods to attain monetary alignment.

1) Open Communication

- Foster open and trustworthy communication about cash issues. Set up a protected house for discussions, guaranteeing each companions really feel heard and understood.

- Commonly examine in in your monetary objectives and focus on any adjustments in revenue, bills, or priorities.

2) Set Shared Targets

- Outline short-term and long-term monetary objectives collectively. This might embody saving for a house, planning for youngsters’s training, or making ready for retirement.

- Be certain that your objectives align with each companions’ values and aspirations.

3) Price range Collectively

- Create a joint funds that displays your shared monetary priorities. Be clear about your particular person spending habits and work collectively to discover a steadiness.

- Commonly evaluation and regulate the funds as circumstances change.

4) Perceive Every Different’s Cash Mindset

- Acknowledge that people typically have completely different attitudes and beliefs about cash. Perceive your companion’s cash mindset, contemplating elements like upbringing and previous experiences. There is a massive distinction between having a shortage mindset and an abundance mindset.

- Be affected person and empathetic, working in direction of discovering frequent floor.

5) Designate Monetary Roles

- Clearly outline every companion’s duties concerning funds. This might contain one individual dealing with invoice funds, whereas the opposite manages investments, for instance.

- Commonly focus on and assess whether or not these roles want changes.

6) Emergency Fund and Insurance coverage

- Prioritize constructing an emergency fund price no less than six months of residing bills to create a buffer for surprising bills.

- Safe acceptable insurance coverage protection as nicely. The quantity of psychological aid my spouse and I skilled after getting two matching 20-year time period life insurance coverage insurance policies with PoilcyGenius not too long ago was enormous. The psychological aid alone is price the price of the premiums.

7) Monetary Dates

- Schedule common “monetary dates” to debate cash issues. Make it an pleasurable exercise by combining it with a meal or a stroll, making a optimistic affiliation with monetary discussions.

8) Compromise

- Acknowledge that compromise is vital. You might not at all times agree on each monetary determination, however discovering center floor ensures that each companions are snug with the alternatives being made.

9) Monetary Training

- Make investments time in monetary training collectively. Attend workshops, learn books like Purchase This Not That, take heed to podcasts that speak about couple’s points, or take programs that improve your understanding of non-public finance.

- Studying collectively will strengthen your monetary literacy and supply a shared basis for decision-making.

10) Search Skilled Steerage

- If wanted, seek the advice of a monetary advisor or marriage counselor. A impartial third occasion can present steering, particularly throughout main monetary selections or if there are persistent disagreements.

Going From Spender To Saver Can Be Onerous

After years of comparatively free spending, transitioning from a spender’s mindset to a frugal one may be difficult. Because the supervisor of our household’s funds, I really feel the stress to make sure our monetary safety, and the extra we’ve got, the safer I really feel.

I am prepared to make excessive sacrifices like consuming solely ramen noodles and water day by day if it means replenishing our checking account. I am additionally prepared to work 60-80 hours per week for so long as essential to obtain monetary freedom sooner. I do know this as a result of it is the method I took to retire at 34 in 2012!

Nevertheless, I acknowledge that my perspective may be thought of excessive. My worry of poverty stems from rising up in creating international locations surrounded by it. Consequently, embracing frugality makes me really feel safer.

Fasting all morning to take pleasure in free meals at a buddy’s lunch occasion brings me pleasure. Carrying the identical garments since 2002 seems like a badge of honor. I even put on my socks till they haven’t one, however two holes in them!

Some may say I’ve a frugality illness. Regardless of efforts to be much less frugal since leaving my day job in 2012, the fact is that shedding a secure revenue supply does not make spending cash any simpler. And neither does having youngsters.

If I am not cautious, my frugality could result in life-style deflation and pointless conflicts with my spouse. On the similar time, if we spend excessively, monetary stress will develop. For the well-being of our household, we should come to a compromise.

Greatest Technique To Grow to be Extra Frugal

If you happen to really feel such as you’ve been spending an excessive amount of and wish to undertake a extra frugal life-style, one efficient method is to contemplate the struggling of others.

Definitely, making a funds, reducing up your bank cards, and avoiding pointless purchases are useful steps. Nevertheless, essentially the most impactful option to shift from being a spender to a saver is to acknowledge the extent of poverty on the planet.

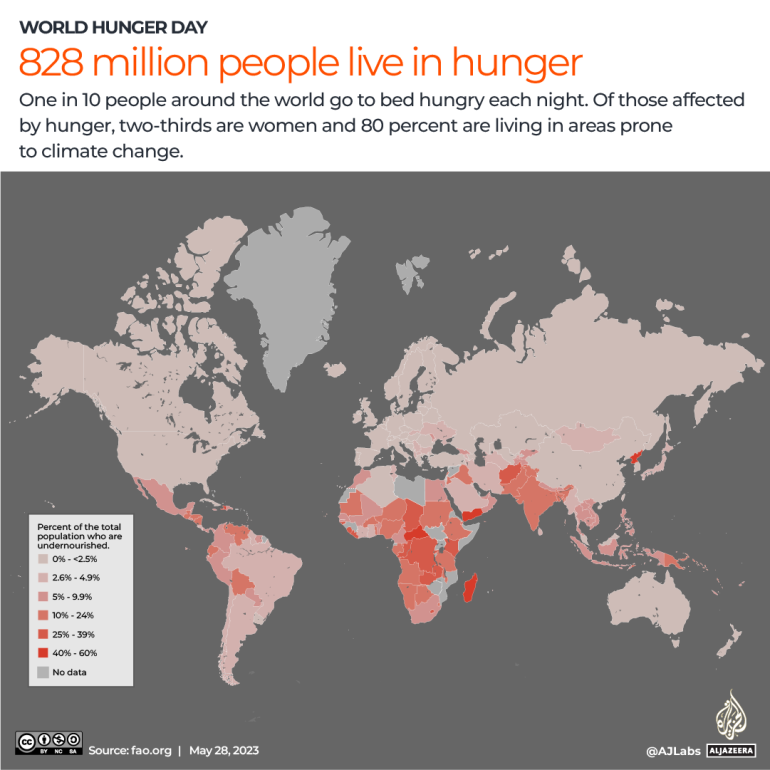

Roughly 828 million folks, or 10% of the worldwide inhabitants, go to mattress hungry each evening. Once you turn into conscious of this and witness the faces of those that are ravenous, you usually tend to keep away from overeating and gaining pointless weight. How are you going to take pleasure in one other slice of key lime pie when there is a youngster on the market who has solely had one bowl of rice and pickles to eat all day?

Round 650 million folks stay in poverty. Experiencing or witnessing poverty is more likely to make you much less extravagant and extra aware of your spending habits. Take into account watching movies on-line or taking a visit to a much less prosperous nation. I guarantee you that such experiences will make you extra conscientious about your spending.

The Want To Talk Higher

My spouse shouldn’t be an enormous spender by any means. She bought her marriage ceremony costume at Goal for $80 in 2008, and to this present day, her favourite retailer stays Goal, the place we go perhaps as soon as 1 / 4. She does not personal fancy sneakers or designer garments. Most not too long ago, she was completely content material with us persevering with to stay in our outdated home till I satisfied her in any other case as a result of my actual property FOMO.

Bettering our communication about monetary expectations is crucial. I can not assume she is aware of what I need, and likewise, she will’t assume what I need. Steady assumptions will solely result in ongoing arguments.

Subsequently, I am including one other objective for 2024: to speak higher. Regardless of writing and podcasting for a few years, I notice I am not the communicator I aspire to be. I must be extra specific when explaining issues to my spouse to reduce miscommunication.

On the finish of the day, spending $48 on lunch earlier than a lunch occasion is not going to interrupt us. Ordering turned out to be transfer as a result of the meals on the occasion was too spicy for the youngsters. Here is to higher dialogue!

Questions And Recommendations

Readers, have you ever discovered it troublesome to get on the identical monetary web page along with your vital different? How do you discover options to undertake related monetary objectives? Have you ever ever gone from being a free spender to all of the sudden an ultra-frugal individual? In that case, how lengthy did you stick with it and what have been you methods?

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I plan to talk to my spouse about many monetary subjects going ahead.

For extra nuanced private finance content material, be part of 60,000+ others and join the free Monetary Samurai publication. Monetary Samurai is without doubt one of the largest independently-owned private finance websites that began in 2009.