Threats to your funding portfolio can come from wherever, together with politics, the economic system, and even your personal thoughts. Understanding the threats to your investments is step one to combating them.

Birch Gold, an organization that helps traders purchase and promote gold, polled its traders about their ideas on the best threats to their well-being.

We mixed a few of the Birch Gold responses with different sources to ship these high 10 threats to your funding portfolio.

1. Your Personal Habits

Within the trendy period, the largest menace to your portfolio is your conduct. With a 24/7 Information Cycle, it’s simple to assume that it’s by no means an excellent time to take a position. The over-cautious could hoard money, which is assured to lose worth to inflation over time. Extra reckless traders could purchase into meme shares, over-invest in cryptocurrencies, or speculate on NFTs on the peak of their costs solely to see their funding costs drop like a rock.

Even when you don’t endure from an excessive amount of or too little warning, you could make some traditional funding errors. For instance, you could find yourself shopping for when hype and costs are at a peak and promoting when public sentiment and costs are at their lowest.

Most individuals can’t strategy their funding portfolio with full stoicism, so one of the best various is to arrange pointers to maintain your conduct in examine. In case you’re liable to reckless investing, take a small portion of your funding portfolio and designate it for giant bets. Make investments the remainder of your portfolio for the long term.

Investing set quantities at common intervals, referred to as dollar-cost averaging, can preserve you from shopping for at all-time highs. It additionally ensures that you simply aren’t merely saving but additionally investing. A well-diversified portfolio can even preserve your conduct in examine. In case your portfolio contains quite a lot of asset varieties, your portfolio is much less more likely to expertise wild swings in worth. This will preserve you from panic promoting when costs drop.

2. Inflation

Inflation is colloquially outlined as an excessive amount of cash chasing too few items. For many years, america loved low inflation, however in 2022 inflation rocked shoppers whereas the inventory market struggled. That 12 months was a sobering have a look at how a lot injury inflation can do to an funding portfolio.

Here is what inflation has ranged over the previous couple of years in response to the Federal Reserve:

Over the long term, your funding portfolio wants to provide returns increased than the speed of inflation, otherwise you’ll lose shopping for energy over time. Excessive charges of inflation can shortly erode the worth of your funding portfolio. Since 1960, the common inflation price in america has been 3.8% per 12 months.

To constrain the impression of inflation, your funding portfolio wants to incorporate asset courses that sometimes outperform inflation (like shares) and belongings that act as a hedge in opposition to inflation (like actual property and treasured metals).

3. Financial Downturns

An financial downturn generally is a double menace to your funding portfolio. Throughout a downturn, you’re extra more likely to lose your earnings, so you could have to dip into your funding portfolio to fund your dwelling bills. Moreover, the inventory market is commonly a “main indicator” of a foul economic system. The worth of your investments could tumble proper earlier than it’s essential withdraw cash out of your portfolio.

Most traders know that the economic system goes by cycles that embrace increase durations and recessions, however financial downturns are by no means predictable in size or severity. Promoting belongings in an financial downturn means you could promote at low costs as a substitute of excessive costs. To counteract this danger, many traders attempt to put money into some defensive shares or different “counter-cyclical” belongings the place costs are likely to rise when the economic system heads right into a tailspin.

4. Inventory Market Volatility

Inventory costs appear to rise and fall for no purpose. Typically excellent news for a corporation leads to inventory costs rising. Different occasions, the excellent news results in a value drop. This head-scratching volatility poses a serious menace to traders, particularly those that purchase and promote particular person shares.

Whereas inventory market volatility is hard to deal with if you’re saving and investing, it’s much more devastating if it’s essential withdraw cash out of your portfolio. Retirees who depend on their portfolio to cowl bills could need to promote belongings to cowl their dwelling bills even when inventory costs fall.

When you have cash you understand you will want inside the subsequent 5 years contemplate investing it in additional steady investments, relatively than the inventory market. That manner you will not be compelled to promote when costs are down.

5. Politically Motivated Spending Payments

Whether or not you are worried extra about Trumponomics or Bidenomics, politically motivated spending payments could also be a menace to your funding portfolio. When the Federal authorities spends in a deficit, the nationwide debt will increase. This implies extra taxpayer {dollars} go to servicing authorities debt.

Though america has not skilled a debt emergency because the Civil Conflict, different nations have had debt emergencies within the trendy period. These nations with trendy economies skilled financial volatility, financial stagnation, and different woes as a result of their nationwide debt load received out of hand. Underneath the unsuitable circumstances, america economic system could expertise comparable points.

6. Excessive Stress “Funding” Gross sales Conditions

Many traders save and make investments diligently for years which ends up in an honest nest egg. However when these traders go in search of monetary recommendation, they may find yourself in high-pressure gross sales conditions.

Monetary “Advisors” could discuss you into fee-loaded complete life insurance coverage insurance policies or pricey annuities. In case you purchase a fee-loaded product that isn’t best for you, you could find yourself spending 1000’s of {dollars} unwinding the choice. In case you follow the product, you could personal underperforming belongings for years earlier than you may cease paying for the product.

At all times make sure that you totally perceive any funding earlier than you progress ahead. If you’re feeling pressured by a quick speaking advisor, inform them it’s essential give it some thought and get a second opinion.

7. Job Loss

Roughly 6 million folks lose or depart their jobs each single month in america. Whereas a lot of these job separations are associated to leaving a job for a greater job, others are layoffs or terminations.

In case you’ve misplaced a job, you possibly can spend weeks or months in search of your subsequent full-time position. Throughout this time, you could have to faucet into your funding portfolio to fund your dwelling bills. In case you’ve received a seven-figure funding portfolio, pulling just a few thousand {dollars} from the portfolio gained’t do you any long-term hurt. However, if it’s essential liquidate a big share of your portfolio, it could take years in your portfolio to get better.

Many individuals can mitigate the danger of job loss by growing a number of streams of earnings, saving an emergency fund, and reducing to a easy funds when their earnings is low.

8. Lack of An Emergency Fund

An emergency fund is your funding portfolio’s first line of protection. Positive, it may possibly show you how to by a job loss, however can even cowl an enormous vary of bills. An enormous stash of money can turn out to be useful when it’s essential cowl an surprising medical invoice, pay for a brand new windshield, or cowl the water invoice if you don’t have a gradual earnings.

When you have money, you may pay for surprising bills with out having to promote belongings or tackle debt.

9. Rising Healthcare Prices

Common inflation is a comparatively new concern for a lot of traders, however rising healthcare prices have been a priority for years. In line with Constancy’s Retiree Well being Care Value Estimate, a 65-year-old who retired in 2023 can anticipate to pay $157,500 in healthcare prices throughout their retirement. This represents vital spending for an individual relying totally on their funding portfolio and Social Safety.

Whereas most individuals will prioritize health-related spending over rising an funding portfolio, you will need to plan for healthcare prices that would rise sooner than the final price of inflation.

10. Inadequate Diversification

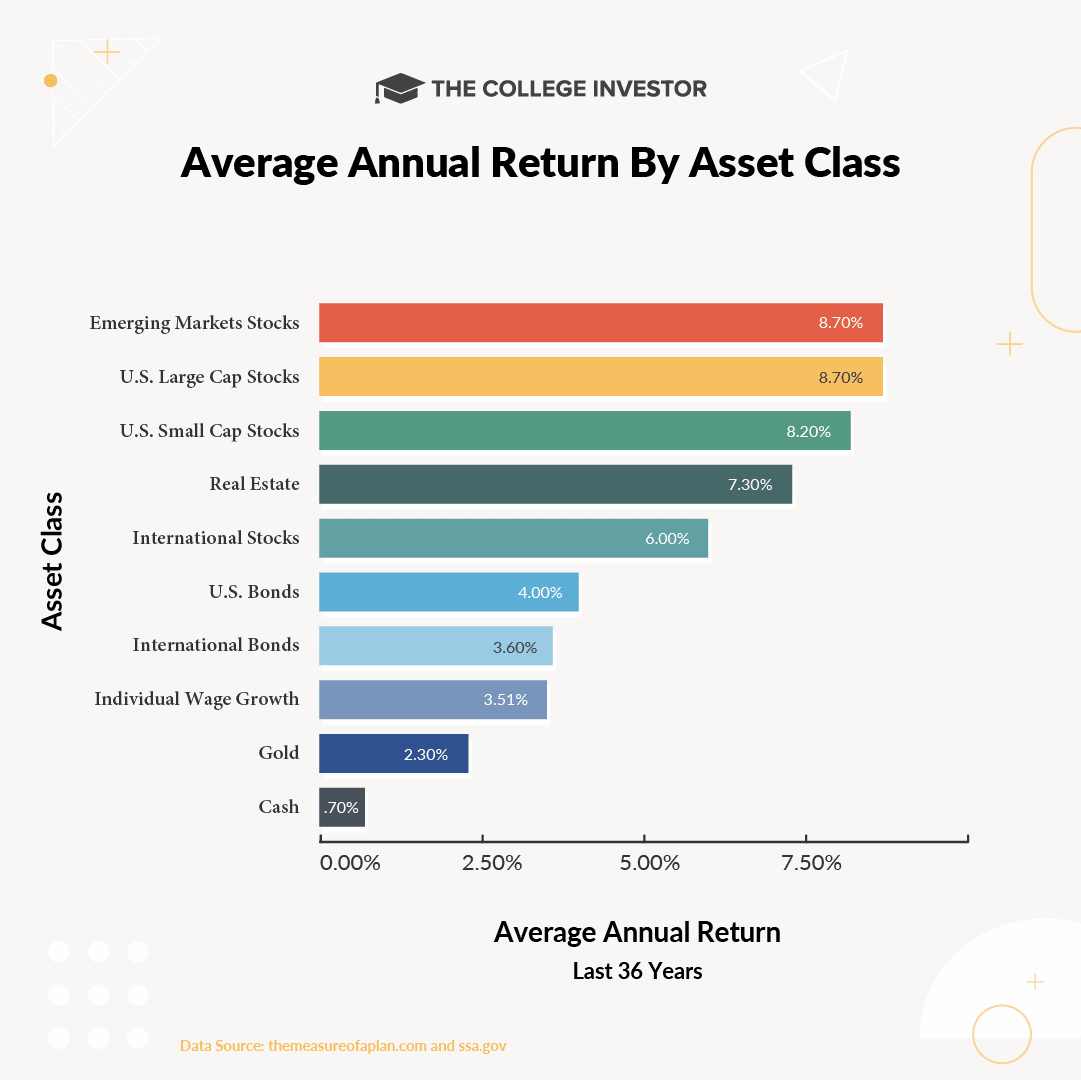

Famed investor, Harry Markowitz mentioned, “Diversification is the one free lunch in investing.” He mentioned this as a result of well-diversified portfolios expertise much less volatility than stocks-only portfolios, and a well-diversified portfolio could carry out higher than one with solely shares.

Investing in quite a lot of asset courses together with shares, bonds, actual property, treasured metals, and alternate options can preserve your portfolio rising even when one or two asset courses are declining.

Remaining Ideas

Though every one among these threats can injury your funding portfolio, you may defend your wealth. Creating financial resilience with an emergency fund, a number of streams of earnings, and the power to chop your spending goes a long-way in the direction of preserving your funding portfolio in place.

From an funding standpoint, controlling your conduct, sustaining correct diversification, and utilizing examined funding methods may also help you throughout financial increase occasions and through busts.