What You Have to Know

- The NFL was accountable for 93 of the 100 most-watched TV broadcasts final 12 months, and introduced in practically $20 billion in income.

- Development has created succession-planning challenges — and will pressure the doorways open for traders pushed by monetary imperatives.

- Bringing in institutional homeowners and personal fairness traders might assist groups elevate capital and provides minority companions a method to money out.

When she was 9 years outdated, Virginia McCaskey attended the first NFL playoff sport, at Chicago Stadium in December 1932. The Chicago Bears, coached by her father, George “Papa Bear” Halas – the group’s founder and proprietor — beat the Spartans of Portsmouth, Ohio, by a rating of 9-0 to develop into the then 12-year-old league’s champions.

Moved indoors due to a blizzard, the sport, a precursor to the annual championship now generally known as the Tremendous Bowl, was performed in entrance of about 11,000 folks on a 60-yard subject utilizing grime and manure left over from a touring circus.

One punt hit the stadium’s organist. Two years later, a radio station proprietor paid $7,952.08 (about $180,000 in at the moment’s {dollars}) to purchase the Spartans and transfer them to Detroit, the place they now play because the Lions.

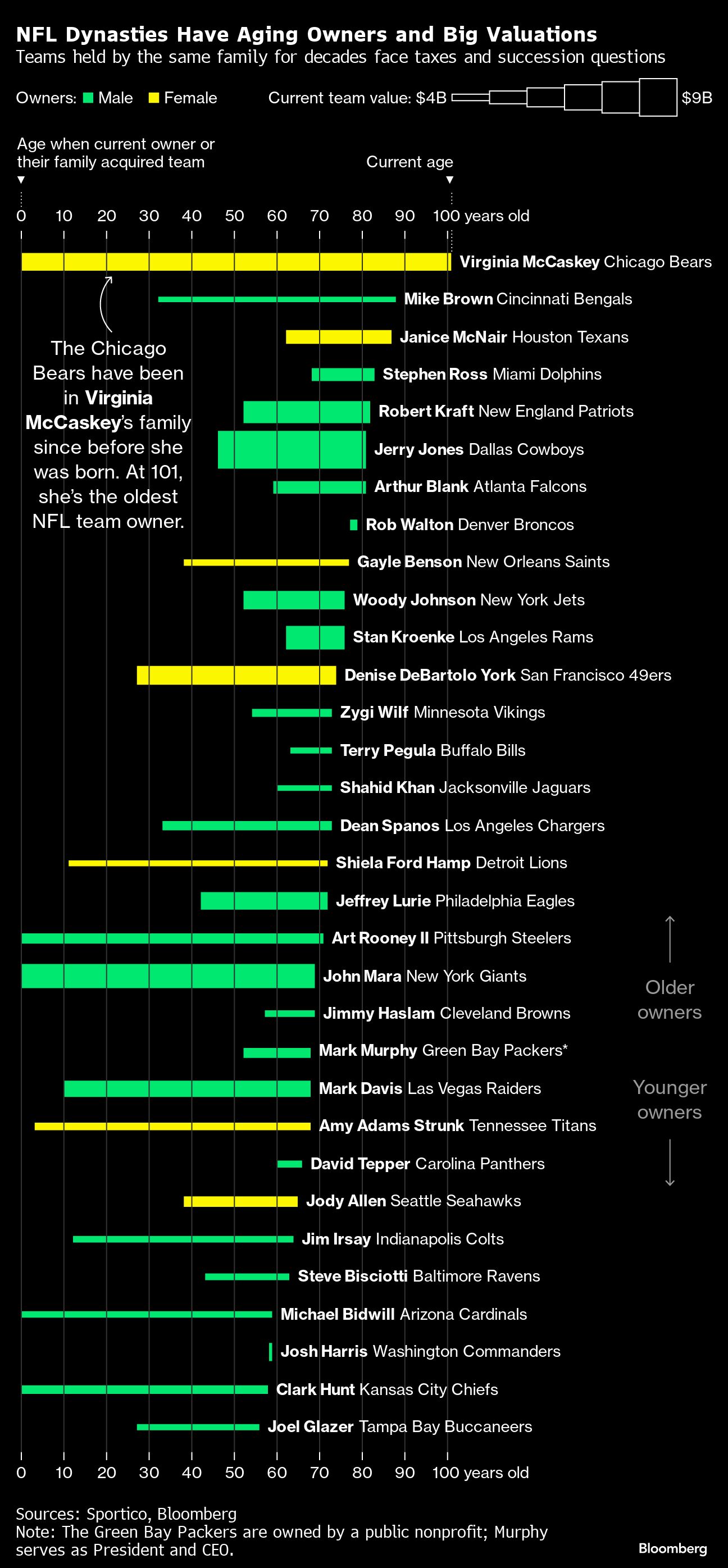

Now, the 101-year-old McCaskey owns the Bears. Earlier than his demise in 1983, her dad got here up with a plan to go the group to McCaskey, his solely dwelling baby, with out saddling her with a heavy tax burden.

Halas divided the 49.35% of the Bears he owned into equal shares for his 13 grandchildren utilizing a set of trusts. Voting energy over these shares went to McCaskey, who already owned shut to twenty% of the group. McCaskey has since raised 11 kids, with 21 grandchildren, 35 great-grandchildren and 4 great-great-grandchildren.

The Bears are a part of a towering U.S. media colossus. The Nationwide Soccer League was accountable for 93 of the 100 most-watched TV broadcasts final 12 months, and introduced in practically $20 billion in income.

McCaskey’s group alone is value $6 billion, in response to the newest estimates by sports-business media outlet Sportico, and throughout the league common franchise valuations rose 69% between 2020 and 2023.

That progress has helped make NFL group homeowners wealthy. But it surely has additionally created succession-planning challenges in a league that venerates household and custom — and will pressure the doorways open for traders pushed by monetary imperatives.

Time for Non-public Fairness?

In September, the NFL shaped a particular committee of 5 homeowners to contemplate ending a block on private-equity funds. Different prime sports activities leagues have already lowered the gates for such traders, however the nation’s hottest one has remained a holdout.

Clark Hunt, an element proprietor and chairman of the Kansas Metropolis Chiefs — who will face the San Francisco 49ers in Tremendous Bowl LVIII in Las Vegas on Sunday — stated in an interview that the league has been watching as different sports activities dip their toes into personal fairness.

“I do assume it’s an avenue that may be useful from a capital standpoint,” stated Hunt, who can also be chairman of the NFL’s finance committee, a member of the panel trying into the private-equity guidelines and a son of Chiefs founder Lamar Hunt.

Clearing a path for personal fairness is prone to end in a collection of offers in brief order, with six to eight groups probably promoting minority stakes inside a 12 months, in response to an government for one NFL group who declined to be recognized as a result of they aren’t licensed to talk publicly on the matter.

Approval of the personal fairness plan is predicted to return on the league’s annual assembly subsequent month, in response to folks conversant in the method.

The NFL declined to remark for this text.

A Historical past of Household Companies

For many of its greater than 100-year historical past, the NFL has operated as a carefully knit collective of household companies — and has taken steps to attempt to hold it that method. Underneath Commissioner Roger Goodell, who has held his publish since 2006, the NFL has repeatedly adjusted its guidelines to make it simpler to go groups throughout generations, as common group values climbed to round $5 billion.

“He appreciates the continuity, the historical past, the pores and skin within the sport that the household ownerships present,” stated Marc Ganis, president of the consulting agency Sportscorp Ltd. and confidant to many NFL homeowners. “You’re making selections for a for much longer horizon if you happen to’re pondering of a group staying within the household along with your kids.”

But the NFL’s prosperity has made sustaining such cohesion a costlier and extra sophisticated proposition, as an growing old cohort of homeowners goals to maintain their households in management and keep away from exposing heirs to a whole bunch of tens of millions in tax liabilities.

Pressured to Promote

“In our expertise, sports activities group homeowners hardly ever if ever promote their groups except they’re pressured to for exterior causes — which is going on with just a few NFL franchises in the mean time,” stated Andrew Kline, a former St. Louis Rams offensive lineman and now funding banker at Park Lane.

The U.S. taxes inherited belongings after a person exemption of $13.6 million at a price of 40%, with an extra 40% levy on belongings handed to grandchildren. The exemption is predicted to be minimize practically in half in 2026, when adjustments handed in 2017 beneath President Donald Trump are scheduled to lapse.

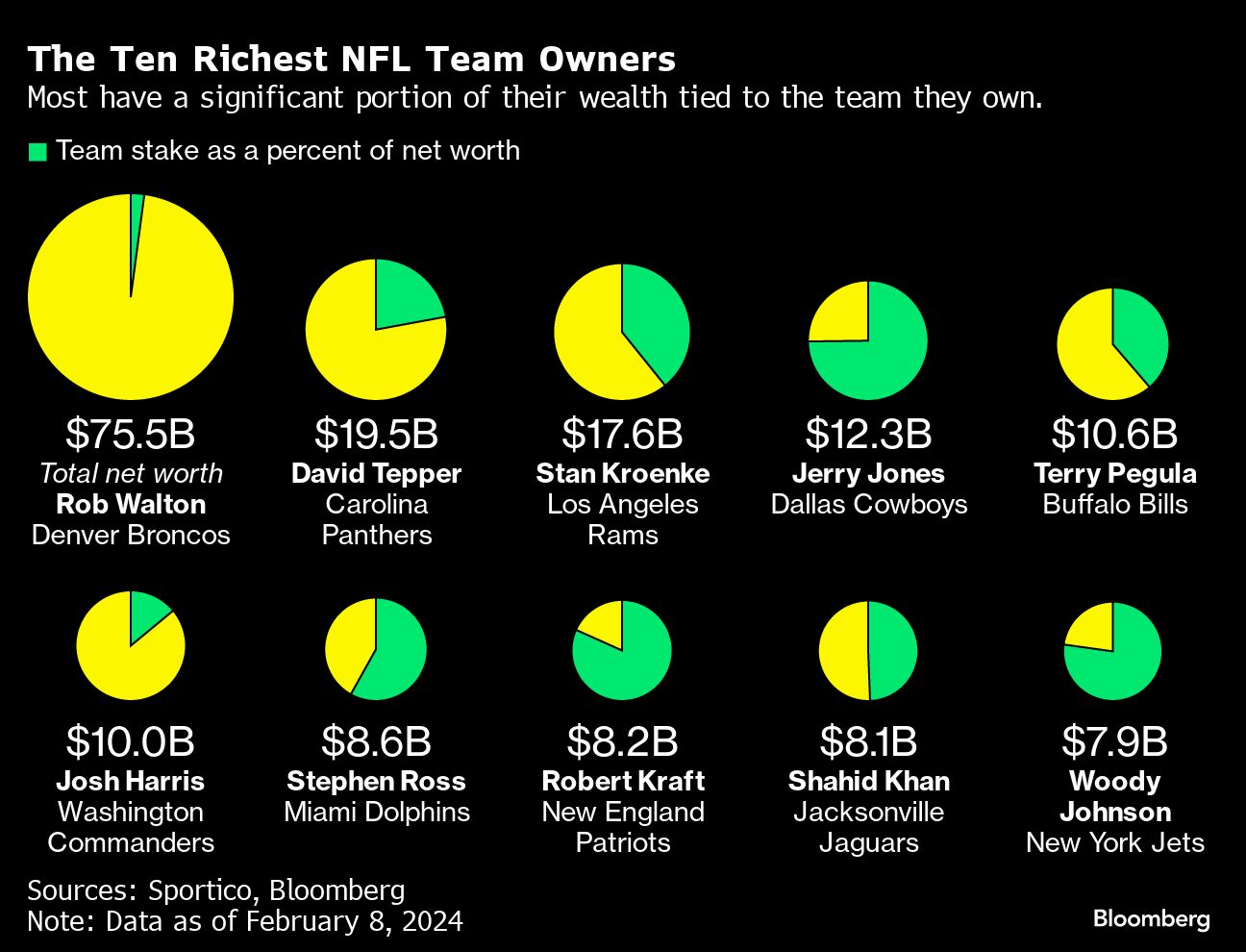

The typical age of the league’s 32 principal homeowners is 72. Seven are 80 or older. Eight groups are nonetheless owned by their founding households. Underneath NFL guidelines, these households should maintain no less than 30% of a franchise, led by a single controlling proprietor. For most of the league’s oldest households, whose wealth is generally tied up of their groups, a big tax invoice might go away them with little selection however to promote.

“When groups have been value $300 million, that was one factor,” stated Ganis. “When they’re value $7 or $8 billion, that could be a unique story.”

Over the previous decade, the NFL has permitted 4 record-breaking franchise gross sales. In 2014, fracking billionaire Terry Pegula and his spouse, Kim, purchased the Buffalo Payments from the property of founding proprietor Ralph Wilson for a then-record $1.4 billion. That deal was adopted 4 years later by the sale of the Carolina Panthers to hedge fund billionaire David Tepper for $2.3 billion.

Walmart Inc. inheritor Rob Walton led a gaggle that in 2022 purchased the Denver Broncos for $4.65 billion after its controlling Bowlen household couldn’t agree on a succession plan. And final 12 months, personal fairness billionaire Josh Harris led a gaggle of greater than 15 companions who paid over $6 billion for the Washington Commanders.

In the meantime, different traders have expressed curiosity in taking a smaller slice of a group. Clearlake Capital co-founders Behdad Eghbali and Jose Feliciano have been stated final 12 months to be weighing a bid for a stake within the Los Angeles Chargers.

Points with New Cash

Some longstanding homeowners have been unnerved by the inflow of latest cash.

“There’s outdated homeowners who need to keep and are very involved with franchise values getting uncontrolled,” stated Frank Hawkins, a former NFL government who runs a consulting agency, “and others who’re very concerned about maximizing their worth.”

Different prime U.S. leagues have handled surging franchise values, which have put shopping for even a part of a group out of attain for all however the ultra-rich, by letting in institutional traders.

Specialised personal fairness companies have arrange funds to purchase passive stakes in franchises within the Nationwide Basketball Affiliation, Main League Baseball and the Nationwide Hockey League.

For the NFL, permitting in such automobiles would assist groups elevate capital and provides minority companions a method to money out.

“To present an instance the price of constructing and renovating stadiums continues to rise at a really quick price,” stated Hunt, the Chiefs proprietor, “and being able to entry exterior capital to assist facilitate tasks like that may be useful.”

Permitting extra exterior traders would shift the character of the league. Historically, restricted companions have been pals of possession, former gamers, native celebrities and others who see the funding as greater than another asset class for his or her portfolio.

Non-public fairness traders would add to the strain to push revenues greater — and for groups to alter arms at ever-higher costs.